Carrier Fulfillment and Distributor Suitability Questions

Overview

The AFFIRM Annuity Order Entry System supports configurable carrier- and distributor-specific questions to be asked during the order entry process, referred to as Carrier Fulfillment Questions and Distributor Suitability Questions. After the order taker has selected the product, AFFIRM automatically selects the correct carrier & distributor questions, each of which may be displayed based on question-specific business rules. As an example, a question may be displayed only for 1035 orders in the state of New York. Questions may be Boolean (yes/no), multiple choice, text field, date, or numeric.

Because AFFIRM allows carriers and distributors to define their own questions, the list of possible questions is infinite. Carriers and distributors can use the Question Application to manage/update their fulfillment questions. You’ll notice that many of the questions are similar – this is because compliance departments typically require specific question wording.

Sample Carrier Fulfillment Questions (Only Supported for New Business)

The screenshot below shows carrier fulfillment questions asked during order entry.

Sample Distributor Suitability Questions

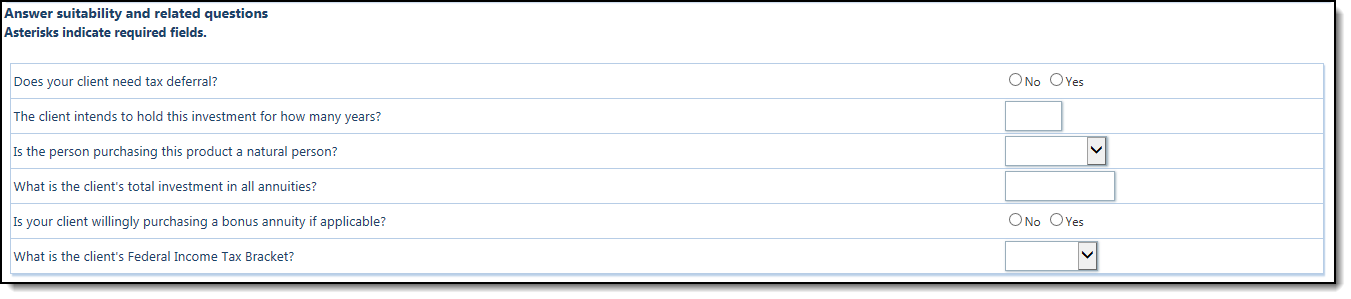

The screenshot below shows distributor suitability questions asked during order entry.

Default Carrier Fulfillment Questions

If a carrier chooses not to configure fulfillment questions, they have the option to use a default set of questions that are supported in DTCC APP/SUB, or to ask no fulfillment questions at all.

The default questions are as follows:

| AFFIRM Data Member | Question Text | DTCC APP Mapping |

| Existing_Policies | Does the applicant have any existing life insurance policies or annuity contracts with this or any other company? | 33/01 record, field 4036 |

| Integer_250 | Is the applicant considering discontinuing making premium payments, surrendering, forfeiting, assigning to the insurer, replacing or otherwise terminating their existing policy or contract? | 33/01 4047 |

| Existing_Withdraw | Is the applicant considering using funds from their existing policies or contracts to pay premiums due on the new policy or contract? This includes taking withdrawals or loans and using these funds to pay premium(s) on a new policy or contract. | 33/01 4047 |

| Integer_570 | To the best of my knowledge as the representative, the applicant has existing life insurance policies or annuity contracts with this or any other company? [Enumeration = Yes/No] | 33/01 4036 |

| Integer_580 | To the best of my knowledge as the representative, the applicant is considering discontinuing making premium payments, surrendering, forfeiting, assigning to the insurer, replacing or otherwise terminating their existing policy or contract? [Enumeration = Yes/No] | 33/01 4047 |

| Integer_590 | To the best of my knowledge as the representative, the applicant is considering using funds from their existing policies or contracts to pay premiums due on the new policy or contract? This includes taking withdrawals or loans and using these funds to pay premium(s) on a new policy or contract. [Enumeration = Yes/No] | 33/01 4047 |

| Invest_ImmediateVarSub | Has the client indicated to invest premium into variable SubAccounts immediately? | 33/01 4048 |

Business Rules

The following business rules are in place to validate the responses to the questions above:

- The answer to 1 must be the same as 4.

- The answer to 2 must be the same as 5.

- The answer to 3 must be the same as 6.

- If 2 or 3 are yes, then 1 must be yes.

- If there is a funding method that is a policy (1035 Exchange or Qualified Policy Rollover/Transfer), then 1 must be yes AND 2 or 3 must be yes.

- Question A will appear if: a) annuity Owner is natural person, age 60 or greater, and lives in CA; OR b) Owner is non-natural entity but the Annuitant is age 60 or greater and lives in CA.

How Answers are Stored in the Database

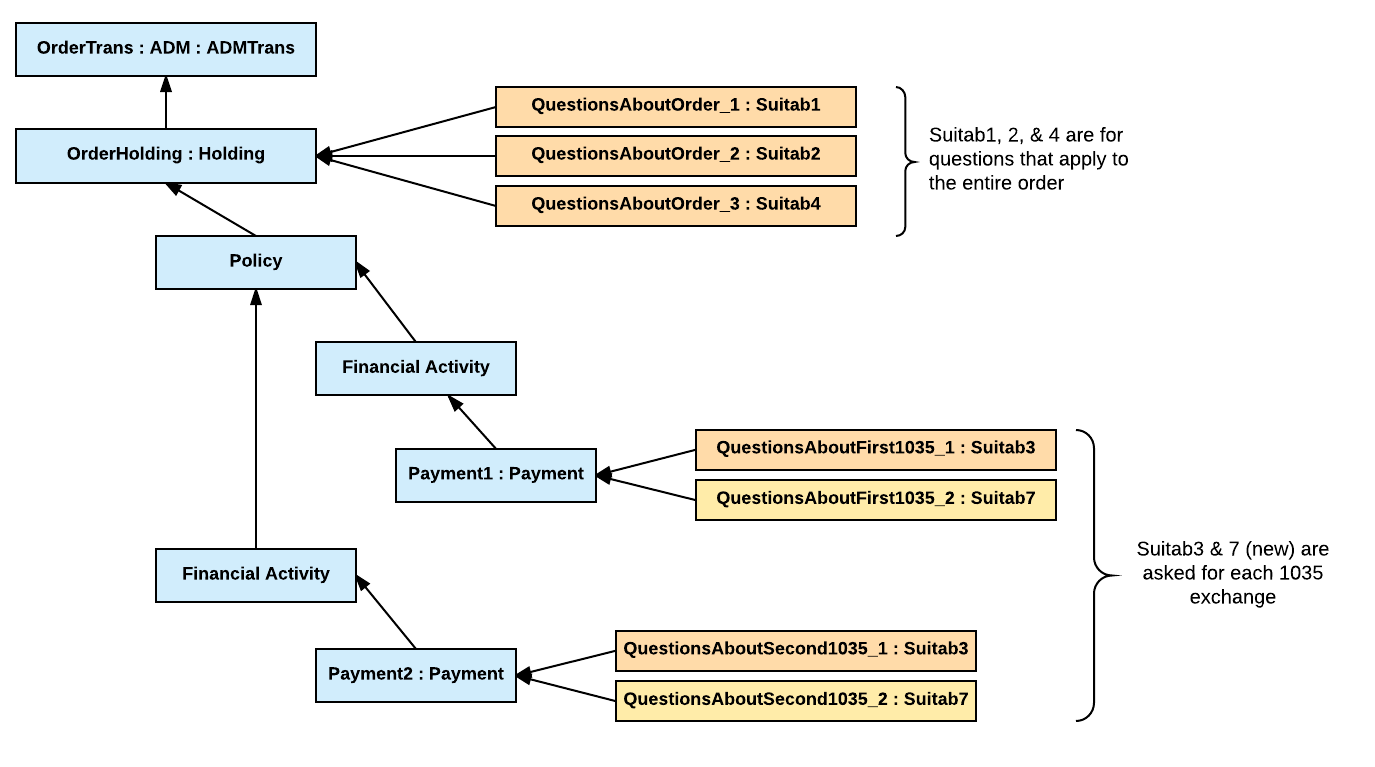

The following diagram shows the organization of suitability questions in AFFIRM.

Using Data Collected from Fulfillment/Suitability Tabs

AFFIRM uses objects in the underlying data store called Suitab1 and Suitab2 as custom extensions to the ACORD Life Standard. All questions have a data element (sometimes referred to as a data member) for storing the response of the user – these are documented in the fulfillment and suitability spreadsheet.

You can access the data collected from the Suitability and/or Fulfillment tabs by reading the data from the Suitab1 and Suitab2 objects respectively. These look like the following in the NBfA data:

<Suitab1 HoldingID="_cc905256-4487-434e-b0e0-3097cb3f4126"/> <!-- Suitab1 holds questions from the distributors suitability tab --> <Suitab2 HoldingID="_cc905256-4487-434e-b0e0-3097cb3f4126"> <!-- Suitab2 holds questions from the AFFIRM questions screen --> <Advisor_AllDocs>1</Advisor_AllDocs> <Aware_ValueChange>1</Aware_ValueChange> <Aware_RateChange>1</Aware_RateChange> <Aware_LongTerm>1</Aware_LongTerm> <Advisor_Objective>1</Advisor_Objective> <Advisor_ContractLost>1</Advisor_ContractLost> <Aware_DeathBenValue>1</Aware_DeathBenValue> <Advisor_ContractEnclosed>1</Advisor_ContractEnclosed> <Existing_Policies>1</Existing_Policies> <Existing_Withdraw>1</Existing_Withdraw> <Invest_Prospectus>1</Invest_Prospectus> <Invest_PurposeLU>3</Invest_PurposeLU> </Suitab2>

The macro formula for retrieving this data would be:

key('AnnuityOrder')/Suitab2/Advisor_ContractLost

…and an example of an “applies when” formula then would be; put an “X” in a form when:

key('AnnuityOrder')/Suitab2/Advisor_ContractLost = 1